What is Earned Value Management?

Earned Value Management (EVM) was originally developed by the industrial manufacturing industry as a financial analysis tool. The US Department of Defence applied it to large defence contracts in the 1960’s but it wasn’t until the late 1980’s, when project management became a recognised discipline for managing complex, capital-intensive engineering, procurement and construction projects, that that the principles of earned value were adopted across the board as a tool for measuring each project’s performance against the critical elements of scope, time and cost.

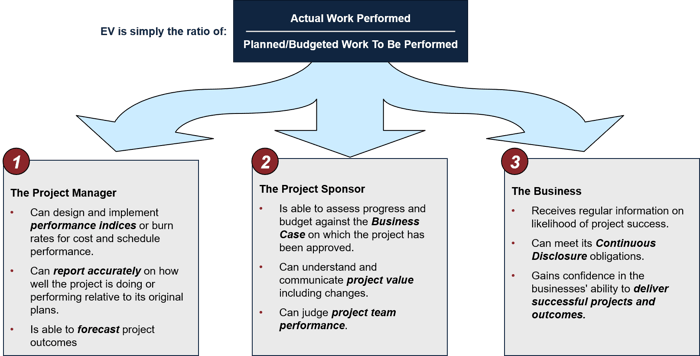

Put simply, EVM is a way of determining the real progress of a project by using a calculation of percentage complete and applying that to a unit of measure such as budget dollars or expenditure, of physical units such as tons of concrete laid or cubic meters of earth moved. This avoids the limitations of just using a purely accounting basis, as many firms still do, as the sole benchmark of project performance.

Effective EVM will include indicators and forecasts of cost performance (over budget or under budget) and schedule performance (behind schedule or ahead of schedule). However, the most basic requirement of an EVM system is that it quantifies progress using the discipline of planned and earned value (PV and EV).

Design of an EVM system uses a structured process to integrate scope, time and cost, against which physical progress measures can be applied. This allows the project team to critically review and physically validate activities.

Application of the EVM metrics then provides predictors of project performance against the Business Case which, when coupled with other Project Assurance methodologies, starts to build the foundation of good project discipline and increases the confidence of stakeholders in the projects ability to deliver what it was initially set out to deliver.

Where and When can EVM be used?

As mentioned, this has traditionally been the domain of large, capital intensive engineering and construction projects that has been almost universally adopted around the globe by engineering and construction companies in the mining, energy, hydrocarbons and defence industries. Research shows that the areas of planning and control are significantly improved by good EVM practices and therefore can be applied to almost any modern capital project.

Market economies demand greater returns on capital, require more for less, in increasingly shorter timeframes and usually with massively increased technological, commercial and financial complexity. Changing environmental norms such as climate change and increasing awareness of social and community licence means that the expectations on predictable performance of almost any project is far more visible, and therefore likely to be scrutinised, more than ever before. This applies from the Boardroom to interest groups and all others in between.

Can EVM be applied to any project?

The answer to this is yes, providing the key determinants of earned value are available;

| Earned Value - Key Determinants |

| A clearly defined business case, that describes the projects key success factors. |

| Well-defined project scope. |

| Plans that identify, quantify and assign the scope, time and cost of the work. |

| An approved baseline budget. |

| A detailed Work Breakdown Structure (WBS) |

| A detailed schedule, with all tasks allocated to the WBS and which shows the project’s critical path |

| A valuation of planned work, called planned value (PV) or budgeted cost of work scheduled (BCWS) |

| Pre-defined "earning rules" (also called metrics) to quantify the accomplishment of work, called earned value (EV) or budgeted cost of work performed (BCWP) |

| Actual Cost (AC) or Actual Cost of Work Performed (ACWP) |

| A plot of project cumulative costs vs time (an S-Curve) that shows both early and late date curves |

| Other Earned Value Management Success Factors |

| Engineering and design definition must be at a sufficient level of definition to identify scope and execution risk and allocate cost and time contingencies |

| A ‘packaging’ philosophy (Package Breakdown Structure - PBS) that matches the contracting, procurement and project commissioning and closeout scope defined in the WBS. Risk and change management processes & controls |

| Clear and concise project governance structures and systems |

| Contracts and purchase orders that include EV reporting requirements |

| Reporting and forecasting systems that can receive data and assess and calculate Earned Value |

Common pitfalls when implementing EVM

EVM requires systematic and disciplined development and implementation. Our experience in developing and applying EVM has highlighted the following common pitfalls.

Procurement and Contracts

The pressure on procurement heads to achieve lowest (initial) cost often overrides the requirement for all purchase orders and contracts to accurately report progress. This tends to cause procurement and contracting teams to adopt purely financial terms without considering the drivers of earned value reporting. Vendor selection needs to also ensure contractual accountability to collect, analyse and report earned value data.

Financial reporting

Whilst most modern Enterprise Resource Planning systems claim to have project modules, there remains a clear gap between an accounting-focused ERP system and a project cost control system. This is because accounting timeframes and reporting inherently lag actual spend, and forecasting discipline is generally done on a one month-ahead accrual basis, which is not sufficiently forward-looking to predict the final project outcome accurately and constantly. This is an essential part of good project management.

Experience also tells us, that CFO’s like to ‘own’ all budgets and tend to corral the reporting of project financials to suit their Board reporting obligations. It is probably a failing of project control systems that finance departments and heads sometimes do not see or understand the benefit of an earned value system, in being able to provide them with accurate monthly reports and forecasts. Even if it is bad news. Public Company Boards of Management and company executives may also benefit from some informed discussion on EVM, which can assist their continuous disclosure obligations.

Optimism bias

Again, based on long experience, we see combinations of inexperienced project management capability, corporate expectations of low-probability time and cost outcomes and the competitive nature of gaining capital that can easily lead to a bias towards the absolute best project or business outcome. Historical project success rates do not support this. The adoption of a fact-based EVM system can help to inform project success at an early enough time to allow corrective action or a change of strategy or messaging.

More information on how to calculate Earned Value and apply it within a project is available here

Return to Project Management

We welcome your feedback on the information in this post, and would be happy to discuss any requirements that you may have: